The Future of Cross-Border Payments with XRP

Exploring how XRP technology is revolutionizing cross-border payments and addressing traditional banking challenges.

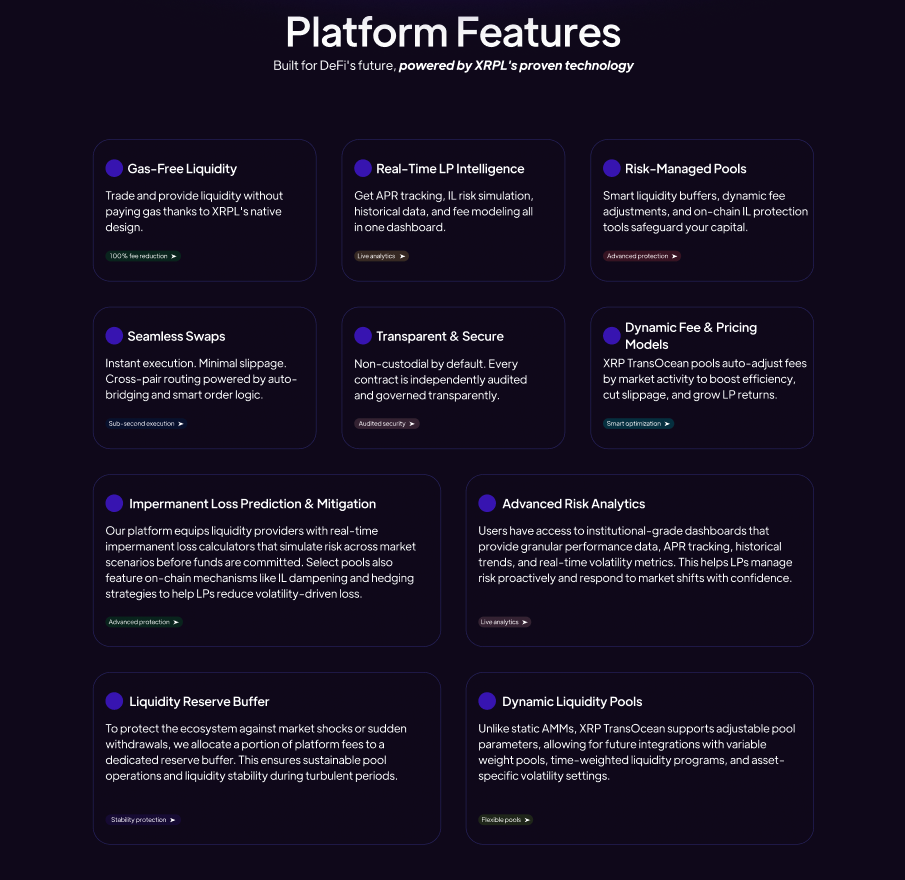

An in-depth look at how liquidity works in DeFi markets and why it matters for the future of finance.

Liquidity is the lifeblood of any financial market, and in the world of Decentralized Finance (DeFi), it takes on even greater importance. Understanding how liquidity works in DeFi markets is crucial for both institutional and retail participants.

Liquidity refers to how easily an asset can be bought or sold without significantly affecting its price. In traditional markets, market makers provide this liquidity. In DeFi, liquidity provision is democratized through automated market makers (AMMs) and liquidity pools.

Many DeFi protocols incentivize liquidity provision through:

Exploring how XRP technology is revolutionizing cross-border payments and addressing traditional banking challenges.

Exploring how XRP technology is revolutionizing cross-border payments and addressing traditional banking challenges.